Cloud-based and comes with a user-friendly mobile app.Payroll is not included in any of the plans and is only available as an additional feature.Lower-tier plans have a cap on the number of billable clients.The software lacks some features that can be essential for fast-growing companies, like the ability to review audit trails.Mobile app functionalities are limited.Mobile app with standout usability and features, allowing for managing your business on the go, including sending invoices, recording expenses, and more.Advanced invoicing features that allow for customizable and professional-looking invoices with automated payment reminders, and recurring billing options.Affordable pricing plans that are cost-effective for small businesses or freelancers.Integration with third-party apps that connect to various business software, providing more flexibility and streamlining workflows.User-friendly interface that is easy to navigate and requires little accounting experience.Cloud-based accounting software can be accessed from anywhere with an internet connection.See Also: Which Small Businesses Will Thrive in 2021

Expensive compared to the competition, especially when considering additional costs for payroll features and limited account users with each plan.Ĭlick here to try QuickBooks Online 2.A learning curve, which may require additional time and resources to fully master the software.Occasional syncing problems with banks and credit cards lead to potential data discrepancies and errors.

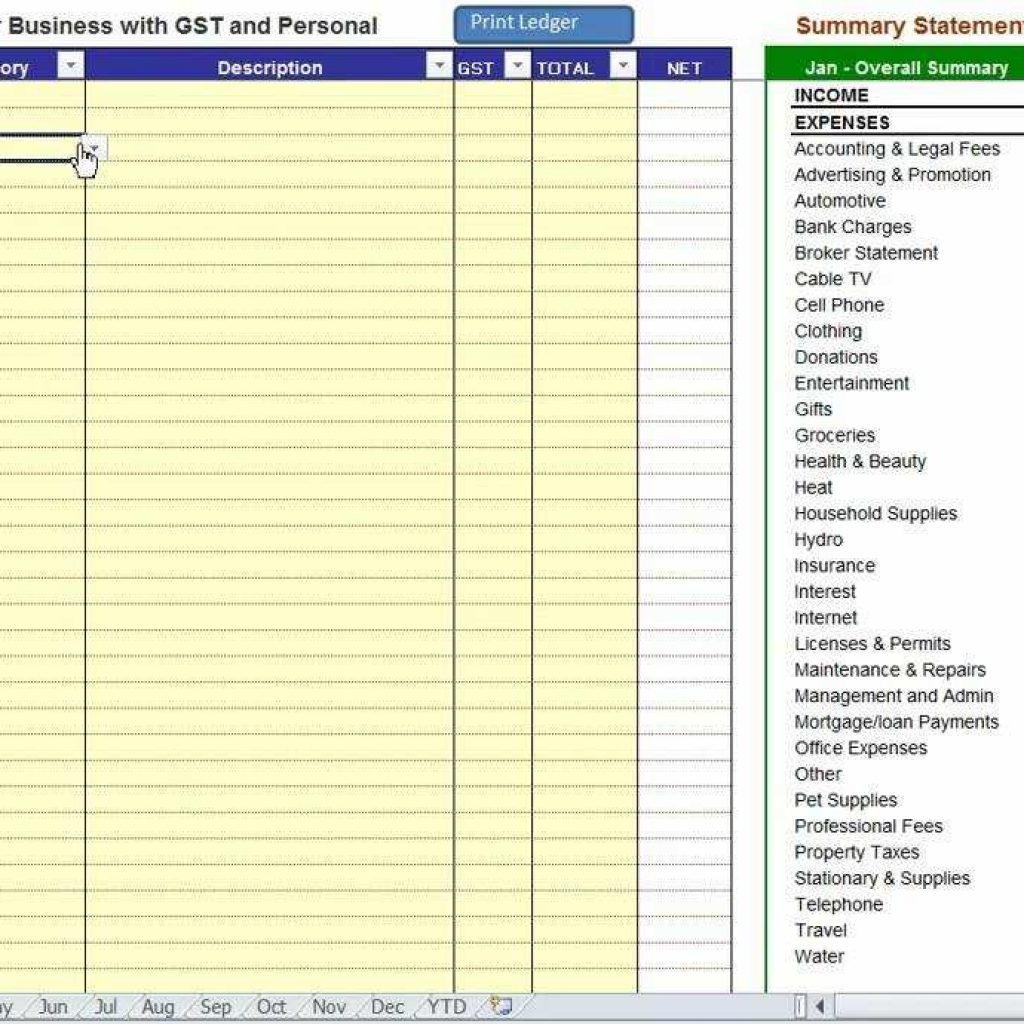

Small business bookkeeping software with inventory upgrade#

An upgrade is required for more users, which can increase costs significantly.Provides excellent customer support, including daily phone support and 24/7 chat support in all plans Cons:.Offers comprehensive record-keeping, invoicing, inventory management, and reporting features.Cloud-based and has a mobile app, enabling easy access and management from anywhere.Integration with third-party applications, providing more flexibility and customization options.Widely used by accounting professionals, which ensures compatibility and support.Scalable for businesses of different sizes and growth stages.Taking a QuickBooks course is a great way to learn about the top accounting software. There are also plenty of online resources and forums available for support. Provides Security – With features like secure login credentials and multi-level authentication, accounting tools provide enhanced security for managing financial data.Enhances Decision-Making – By providing easy access to financial data, accounting software helps small businesses make better decisions that can improve their bottom line.Generates Reports Quickly – One of the most important functions of accounting software is generating reports such as income statements and balance sheets more quickly and accurately.Reduces Human Error – With its automated processes, accounting software significantly reduces the chances of human errors within a business.Improves Efficiency – By automating and organizing financial operations, accounting software helps improve the overall efficiency of a business.Automates Financial Processes – Accounting software automates processes like billing, invoicing, and payments, making them faster and easier to handle.Here are six key benefits of having accounting software in your small business: Benefits of Accounting Software for Small BusinessĪccounting software is essential for small businesses, as it helps streamline financial operations and reduce the amount of time spent on administrative tasks. This helps to reduce errors while saving time on routine tasks such as reconciling bank statements and generating invoices and financial reports. As a result, business owners can focus more on what’s really important, like sales and customer service, freeing up time for other necessary activities. Accounting software is a powerful tool that streamlines the financial management process for businesses of all sizes. It simplifies accounting tasks like invoicing, payment recording, expense tracking, report generation, and account auditing by automating them.Īccounting software also features integration with business bank accounts, automatic expense categorization, and transaction tracking, so businesses can easily manage their finances with real-time financial information and built-in error-checking features.

0 kommentar(er)

0 kommentar(er)